In today's rapidly evolving and competitive job market, students from more challenging socioeconomic backgrounds often face numerous barriers when it comes to accessing opportunities in certain industries.

One such field is the insurance market, which often requires a strong educational background, industry connections, and financial resources that may be out of reach for many disadvantaged students. However, there has been a growing recognition in the sector that diversity, equity, and inclusion are vital for success and that achieving this diversity begins by providing insurance job opportunities at the grassroot level.

Why are DEI strategies and champions so important within insurance?

According to a recent report by KPMG and the Association of British Insurers, 74% of insurance CEOs believe DEI progress has moved too slowly, and 78% believe they have a responsibility to drive greater social mobility in their organisations.

Why are industry leaders realising the importance of DEI in insurance? This is because there are numerous proven advantages to developing an effective DEI strategy:

-

Enhanced profitability: Organisations that possess diverse leadership teams have been shown to generate 19% more revenue.

-

Competitive advantage: Organisations that have diverse executive teams are 35% more likely to outperform their industry peers financially.

-

Improved creativity and productivity: The presence of a variety of ideas and perspectives within a team can lead to breakthroughs in creativity and an increase in productivity.

-

Attraction and retention: Diversity is a key consideration for 85% of job seekers when reviewing new employment opportunities.

-

Innovation: Inclusive companies are 1.7 times more likely to be leaders in innovation within their respective markets.

-

Enriched customer relationships: Demonstrating diverse work practices and culture can deepen customer relationships and enable organisations to better meet their needs.

How Gravitas and Lloyds of London are collaborating on social mobility

As part of our wider DEI strategy, Gravitas insurance recruiters have been looking for opportunities to tackle social mobility within the market. Breaking down barriers and offering valuable insights to students from a lower socioeconomic background is a crucial step towards promoting equity and inclusivity in the insurance industry. By addressing the challenges faced by these students and offering them access to information and resources, we can help create a more diverse and representative workforce that reflects the broader population for future generations.

Gravitas recently partnered with the world’s leading insurance and reinsurance corporate body, Lloyds of London, to promote their DEI plan focusing on data and targets, talent and attraction, talent management and external promotion, advocacy and engagement.

As part of this we organised a series of regular Lloyd’s tours for bright sixth form students, in their penultimate year to widen their horizons, who otherwise would have never thought of a career in insurance. By helping them consider a school leaver programme, apprenticeship degrees, or subjects at Uni that would be crucial to stepping into the insurance world.

Our first tour was a huge success

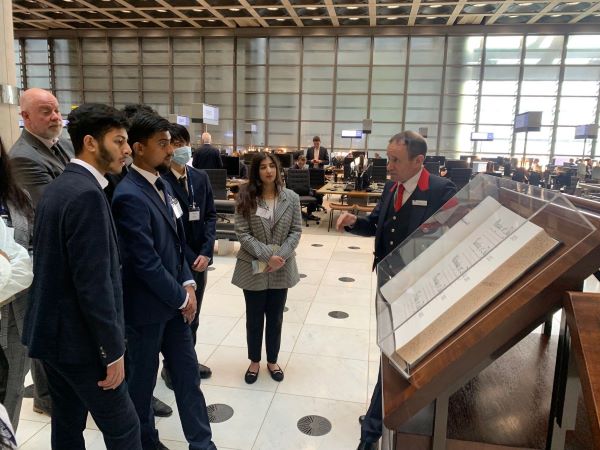

The first of the tours took place on Wednesday 27th September at 10.30am, explaining the structure of the market and how it operates, the roles of underwriters, brokers, and the Corporation of Lloyd’s, with supporting facts and figures. It also covered the history of the market and highlighted some items of historical interest, such as the Loss Book, Lutine Bell and Adam Room.

Thank you to our amazing tour guide Paul Warden for inspiring the students and offering valuable insights into the past, present, and future of Lloyd’s! Here are some pictures from our first tour. We look forward to continuing this initiative later this year.

Student Feedback

'"Visit to the Lloyd's Building is like embarking on an architectural journey through the heart of innovation and design, where every angle and line tells a story of modernity and creativity. In the Lloyds building the art of insurance comes to life. Overall amazing trip and gained a lot of further knowledge about insurance.'" UI

"Today was extremely interesting, we learnt many things but what intrigued me the most was learning how such a successful business, Lloyds, started out from a small coffee shop and how it has now expanded and branched into the insurance company we know today. And how the modern business still holds onto its humble beginnings and traditions such as the bell. I’ve learnt that there are many ways to get into this field such as degree apprenticeships, and that they are looking for a huge diverse range of people.'" AH

"Very fun trip that has opened my eyes to a potentially different career path to the one I thought I would take. Very educational and interesting.'" AK

'"Very insightful! I have learnt so much more about insurance and the different types of opportunities available." IF

"Lloyd's offered a great insight into finance and insurance which is beyond the gaze that most of us share.'" TL

'"I would like to say that the tour of the Lloyd's building was very insightful and allowed me to grasp a greater knowledge on insurance and how it works. It has opened my mind to potentially applying for an apprenticeship there, so I'd like to thank you and the others involved for letting me be involved in this opportunity.'" YM